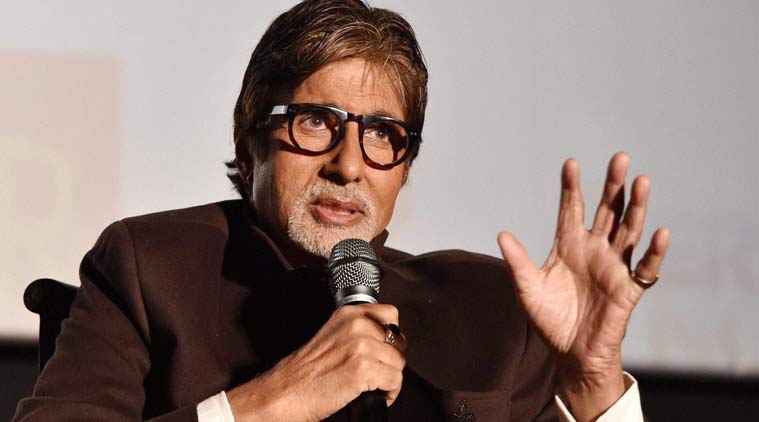

After getting entangled in the Panama Papers controversy, Amitabh Bachchan is back in the news for a legal case. His income tax case from the year 2001 will be reopened as per the Supreme Court orders.

As per the orders, the Income Tax Department has been granted permission to reopen a tax case against Amitabh Bachchan pertaining to his income for the assessment year 2001-02. The income which would be assessed is the income earned by the actor for his show ‘Kaun Banega Crorepati’.

According to the IT department, Amitabh Bachchan owes approximately Rs 1.66 crore in taxes. In the year 2008, the Bombay High Court had granted him relief under section 80RR in this case as the fees that was paid to him was from a foreign company called E-Entertainment Ltd (EEL). But on the contrary, the Income Tax department stated that income has to be earned outside India and the claimant should go out of India and then through banking channels should bring the professional earning and only then the person is eligible to claim tax deductions under 80RR.

Talking about the same, the legal advisory of Amitabh Bachchan has stated, “The Supreme Court has given the respondent, i.e. Mr Amitabh Bachchan, the right to appeal against the re-assessment order.”

A strongly opinionated, free-spirited, budding Bollywood journalist, she likes to write anything in her own quirky style. When not running around to get assigned tasks completed, you will find her either painting, indulging in photography or dreaming in the la la land.