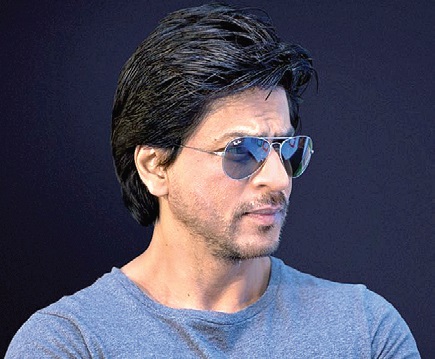

With the Enforcement Directorate recording statement of Indian Bollywood actor Shah Rukh Khan in a foreign exchange violations case, investigations into a major case of alleged financial irregularities in T-20 cricket tournament IPL is set to complete soon.

Khan is being probed on a specific charge of irregularities in the sale of shares of Knight Riders Sports Pvt Ltd (KRSPL), a franchise owned by his company Red Chillies Entertainment, to a Mauritius-based company.

Sources said the agency, after this questioning, is expected to issue a final show-cause notice by December or early next year under FEMA in the probe involving Kolkata Knight Riders (KKR) and related entities.

The sources said the recent questioning happened when the actor reached the agency’s office in Ballard Estate here on the evening of November 10 and spent over three hours with the investigators probing the case under provisions of the Foreign Exchange Management Act (FEMA).

Khan could not be reached for comments.

The case, dating back to 2008-09, pertains to the share sale of KRSPL, co-owned by Khan and his co-actor and friend Juhi Chawla and her husband Jay Mehta, to a Mauritius-based company owned by Mehta.

The central agency is probing allegations that shares sold to the Mehta-owned Sea Island Investments were allegedly undervalued by eight to nine times by Khan’s business end.

The actor had been questioned by the ED in this case earlier in 2011 apart from the business dealings of Kolkata Knight Riders, the IPL team co-owned by the actor.

They said during the latest round of questioning, Khan “cooperated” with the investigators and handed them over some relevant documents.

“He has assured that his legal and Chartered Accountancy firms will be in active touch with the agency so that the probe could be completed soon,” they said.

They added that all the aspects of investigation on this IPL probe case are more or less complete and the final notice will now be served. .

Under this case, at the time of incorporation in 2008, Red Chillies had 9,900 shares of KRSPL.

The valuation report, made by an external agency on commission from ED last year, said when the equity shares of KRSPL were issued to Sea Island Investments, the fair value per equity share of KRSPL should have been between Rs 70-86.

However, the shares were issued at a value of Rs 10 each.

According to the FEMA rules, the price of shares issued to persons residing outside India should not be lower than the price worked out under the guidelines set by stock market regulator SEBI in case of a listed company, or on the basis of fair valuation of shares by a chartered accountant as per guidelines of the erstwhile Controller of Capital Issues (CCI).

Inputs by PTI

Leave a Reply